House Mortgages And What You Ought To Learn About Them

Created by-Oakley CaseAs you plan to buy your new home, the idea of getting a mortgage will pop up frequently. You need to learn all you can before you pursue such a loan, but where can you get such an education? This article is the perfect place to start, so check out the advice below.

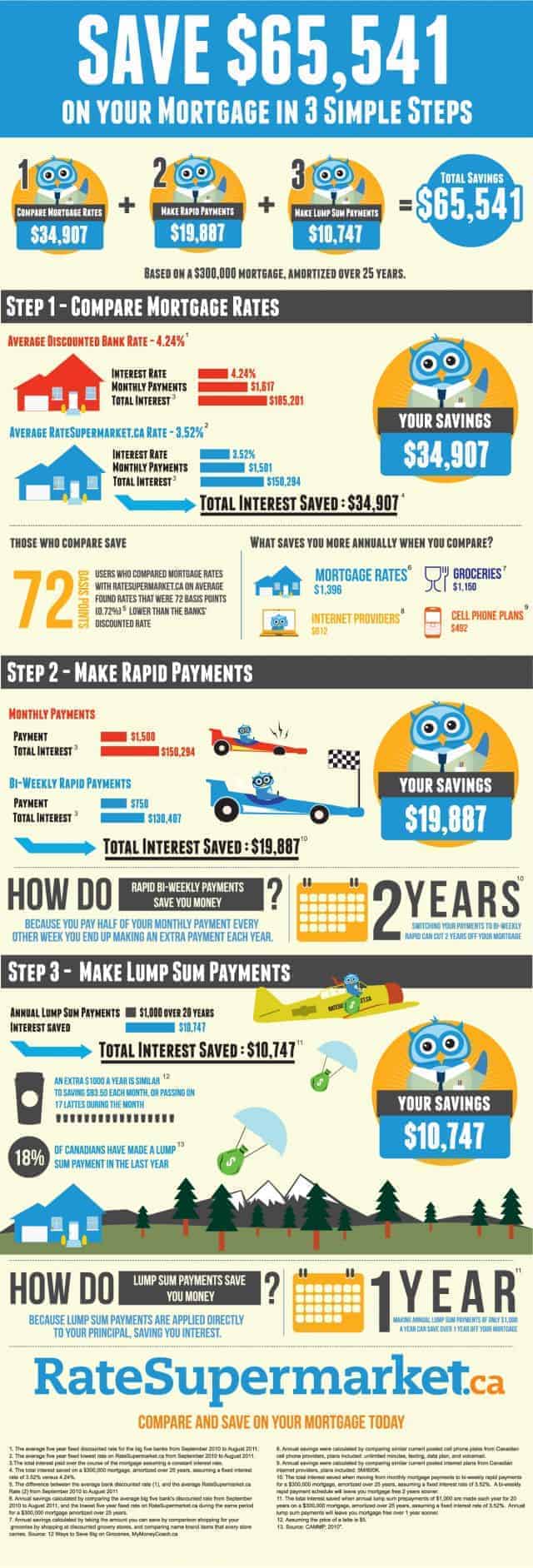

When it comes to getting a good interest rate, shop around. Each individual lender sets their interest rate based on the current market rate; however, interest rates can vary from company to company. By shopping around, you can ensure that you will be receiving the lowest interest rate currently available.

Know your credit score before beginning to shop for a home mortgage. If your credit score is low, it can negatively affect the interest rate offered. By understanding your credit score, you can help ensure that you get a fair interest rate. Most lenders require a credit score of at least 680 for approval.

Prior to applying for a mortgage, you need to know what is in your credit report. Recent years have made it more difficult to get a mortgage, so a solid credit report is critical if you wish to qualify for a loan with good terms.

Before you apply for your mortgage, be sure you're in possession of all the documents that are necessary. Most lenders will require basic financial documents. Tax documents, bank statements and pay stubs will likely be required. It will be an easier process if you have these documents together.

Pay down your debt. You should minimize all other debts when you are pursuing financing on a home. Keep your credit in check, and pay off any credit cards you carry. This will help you to obtain financing more easily. The less debt you have, the more you will have to pay toward your mortgage.

Be sure you're looking over a lot of institutions to deal with your mortgage so you have a lot of options. Look at their reputations on the Internet and through friends, and look over the contract to see if anything is amiss. When you know all the details, you can make the best decision.

If you are looking to buy any big ticket items, make sure that you wait until your loan has been closed. Buying large items may give the lender the idea that you are irresponsible and/or overextending yourself and they may worry about your ability to pay them back the money you are trying to borrow.

Current interest rates on home mortgages are lower than they have been in years. Experts expect them to begin increasing again shortly, so now is a great time to purchase a home and finance it at a low rate. The shorter the term of the mortgage, the better the rate you will be able to get.

Know your mortgage interest rate type. When you are obtaining home financing you should understand how the interest is calculated. Your rate could be fixed or it could be adjustable. With fixed interest rates, your payment will usually not change. Adjustable rates vary depending on the flow of the market and are variable.

Avoid interest only type loans. With an interest only loan, the borrower only pays for the interest on the loan and the principal never decreases. This type of loan may seem like a wise choice; however, at the end of the loan a balloon payment is needed. This payment is the entire principal of the loan.

If you are having problems paying your home mortgage, contact your lender immediately. Don't ignore the problem. That'll only make the issue worse. Your lender can show you many different options that may be available to you. They can help you keep your home by making the costs more affordable.

Avoid dealing with shady lenders. Though many are legitimate, others are unscrupulous. If they offer strange financing options, with no money down, there is a good chance you are being taken. Avoid lenders that charge high rates and excessive fees. Avoid lenders that say a poor credit score is not a problem. Don't work with anyone who says lying is okay either.

Before signing a home mortgage, check out the lender. Do not blindly trust what your lender says without checking things out. Ask around for information. Search the web. Check the BBB. The more you know going into the loan process, the more money you will potentially save.

Answer every question on your home mortgage application absolutely honestly. There is no benefit in lying, as all of the information that you provide will be thoroughly examined for accuracy. Additionally, a small fib could easily lead to your denial, so just be honest from the start so that you have the best chances.

Think about a mortgage that will let you make payments bi-weekly. This gives you an additional two payments every year. This shortens the term of your loan and how much interest you pay. If you are paid biweekly, this is an even better arrangement.

You should work to find a cosigner for your loan before applying. If you have anyone in your family with great credit, a business, history with the lender, etc, then having their signature alongside yours will put your application in a much better light. So seek out family, friends, business partners, and others who could cosign for you.

When hiring a mortgage broker, find out if they have any additional certifications. These don't just offer additional expertise in your personal situation, but show that the broker is committed to continuing their education and learning all they can about the field they work in, showing their dedicated to their craft.

Now that you've finished reading, you're ready to start the process. Use the tips here to help you during this process. Once you do, your mortgage will be forthcoming.